प्रधानमंत्री नरेंद्र मोदी ने 15 अगस्त 2025 को दीवाली तक GST 2.0 सुधार की घोषणा की है, जो आम आदमी के लिए एक बड़ा उपहार साबित होगा। वर्तमान चार-स्लैब GST संरचना (5%, 12%, 18%, 28%) को सिर्फ दो मुख्य स्लैब (5% और 18%) में बदला जाएगा। इससे 90% वस्तुएं 28% से घटकर 18% हो जाएंगी और 12% स्लैब की सभी वस्तुएं 5% में आ जाएंगी। यह सुधार उपभोग को बढ़ावा देगा, मंहगाई कम करेगा और व्यापारियों के लिए अनुपालन आसान बनाएगा।

GST Registration क्या है और क्यों जरूरी है?

Goods and Services Tax (GST) Registration एक अनिवार्य प्रक्रिया है जिसके तहत व्यापारियों को 15-digit unique GSTIN मिलता है. यह registration tax compliance, input tax credit और business credibility के लिए आवश्यक है.

PM Modi का Latest GST Reform Announcement:

प्रधानमंत्री नरेंद्र मोदी ने 17 अगस्त 2025 को घोषणा की कि दिवाली तक next-generation GST reforms लागू होंगे जो गरीबों, middle class, entrepreneurs, traders और business men को फायदा पहुंचाएंगे.

मुख्य बदलाव:

- Current 4 tax slabs (5%, 12%, 18%, 28%) को 2 slabs (5% और 18%) में convert करना

- 99% items को 12% slab से 5% slab में shift करना

- 90% items को 28% slab से 18% slab में move करना

- Sin goods के लिए 40% special rat

Related Articles:

- iPhone 17 Series Price Hike: Apple iPhone 17, 17 Pro & 17 Pro Max $50 More

- Huawei MateBook Fold – दुनिया का पहला फोल्डेबल लैपटॉप

- Samsung Galaxy S25 Edge भारत में लॉन्च: कीमत, फीचर्स और स्पेसिफिकेशन

GST Registration की Threshold Limits 2025

Special Category States:

Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Sikkim, Uttarakhand, Himachal Pradesh, J&K

GST Registration के लिए Required Documents

Individual/Sole Proprietor के लिए:

Partnership Firm के लिए:

- Firm का PAN Card और सभी partners का PAN

- Partnership Deed

- Partners का Aadhaar Card

- Business address proof

- Bank account details

Private Limited Company के लिए:

- Company और Directors का PAN Card

- Certificate of Incorporation

- MoA और AoA

- Business address proof

- Bank account details

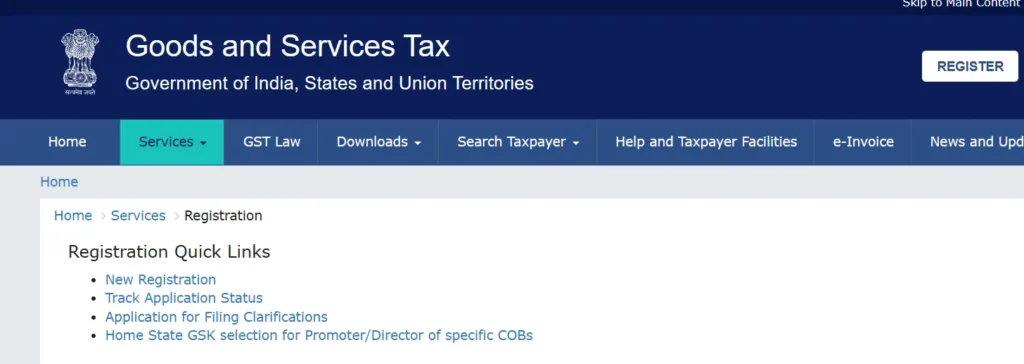

Step-by-Step GST Registration Process 2025

Part A: Initial Application

Step 1: GST Portal Access

- Visit www.gst.gov.in

- Click Services → Registration → New Registration

Step 2: Basic Information

- Select “Taxpayer” from dropdown

- Choose State/UT और District

- Enter Legal Business Name (PAN database के अनुसार)

- Enter PAN Number

- Enter Email Address और Mobile Number (Primary Authorized Signatory का)

Step 3: OTP Verification

Step 4: TRN Generation

Part B: Detailed Application

Step 5: TRN Login

Step 6: Business Details Fill करें

10 tabs में information भरनी होगी:

- Business Details – Trade name, constitution, composition scheme option

- Promoter/Partners – Personal details, photos upload

- Authorized Signatory – Signatory information

- Principal Place of Business – Business address details

- Additional Places – Other business locations (if any)

- Goods and Services – Top 5 goods (HSN codes) और services (SAC codes)

- Bank Account Details – Account number, IFSC, bank statements

- State Specific Information – Local requirements

- Aadhaar Authentication – E-KYC process

- Verification – Final verification

Step 7: Document Upload

- सभी required documents upload करें (PDF/JPEG, max 100KB)

- Photos, address proof, bank details verify करें

Step 8: Final Submission

- Digital Signature Certificate (DSC) या E-Signature से sign करें

- Companies और LLPs के लिए DSC mandatory है

Step 9: ARN Generation

Processing Time और Approval

- Normal processing: 6 working days

- Status tracking: ARN number से track कर सकते हैं

- GSTIN approval के बाद मिलेगा

GST Registration Fees और Charges

Government Fees:

GST Registration बिल्कुल FREE है – कोई government fee नहीं

Professional Service Charges (Optional):

| Business Type | Estimated Cost |

|---|---|

| Proprietorship | ₹1,000 – ₹3,000 |

| Partnership/LLP | ₹2,500 – ₹5,000 |

| Private Limited | ₹4,000 – ₹8,000 |

ClearTax GST और Good Tax Service की Features

ClearTax GST Software Benefits:

- AI-powered ITC reconciliation – automatic matching

- PAN-level filing – GSTR-1 से GSTR-9C तक

- 3x faster experience – 3 days में filing vs 9-18 days

- 200+ validations – error detection

- 99.99% uptime guarantee

- Smart recommended actions – post-reconciliation insights

Good Tax Service Features:

- End-to-end GST compliance support

- Expert assistance for registration और returns

- Real-time support और guidance

- Affordable pricing for small businesses

New GST Reforms 2025: PM Modi’s Diwali Gift

Reform Benefits for Different Categories:

- Daily essentials जैसे butter, ghee, packaged food 5% tax पर

- Medicines और medical equipment – 12% से 5% या nil

- Basic clothing, footwear – cheaper हो जाएंगे

- Health और Life Insurance premiums – 18% से 5% या nil

- Electronic items (TV, AC, Fridge) – 28% से 18%

- Household goods – 12% से 5% slab

Entrepreneurs और Traders के लिए फायदे:

- Simplified tax structure – केवल 2 main slabs

- Reduced compliance burden

- Better cash flow due to lower rates

- Enhanced business credibility

- Easier interstate trade

- Improved input tax credit mechanism

- Export competitiveness increase

- Reduced litigation और disputes

GST Registration के Major Benefits

1. Legal Compliance और Credibility:

- Legal recognition of business

- Enhanced credibility with customers और suppliers

- Government tenders में participate कर सकते हैं

2. Input Tax Credit (ITC) Benefits:

- GST paid on purchases की credit claim कर सकते हैं

- Cash flow improvement through ITC

- Overall tax burden reduction

3. Business Expansion Opportunities:

- Interstate sales without multiple registrations

- E-commerce platforms पर sell कर सकते हैं

- Competitive advantage over unregistered entities

4. Simplified Operations:

- Online processes – registration से filing तक

- Unified tax system – multiple taxes की जगह एक GST

- Digital record keeping

Who Must Register for GST?

Mandatory Registration Categories:

- Turnover crossing threshold limits

- All e-commerce sellers (Amazon, Flipkart, etc.)

- Interstate suppliers (any turnover)

- Casual taxable persons

- Non-resident taxable persons

- Input Service Distributors

- TDS/TCS deductors

Voluntary Registration:

Small businesses भी voluntarily register कर सकते हैं ITC benefits के लिए

GST Registration Process के लिए Important Tips

Documentation Tips:

- सभी documents clear और readable होने चाहिए

- File size 100KB से कम रखें

- JPEG या PDF format में upload करें

Common Mistakes to Avoid:

- Incorrect PAN details न भरें

- Mobile/Email properly verify करें

- 15-day deadline के अंदर complete करें

- HSN/SAC codes correctly select करें

Professional Help vs Self-Registration:

- Simple businesses – self-registration possible

- Complex structures – professional help recommended

- Time constraint – CA/consultant से help लें

Conclusion: GST Registration और Upcoming Reforms

GST Registration 2025 में और भी आसान हो गया है नए guidelines और digital processes के साथ। PM Modi के upcoming GST reforms से businesses को और भी ज्यादा फायदा होगा:

Key Takeaways:

- Registration process completely online और free है

- New reforms से tax burden significantly कम होगा

- Business credibility और expansion opportunities बढ़ेंगी

- Simplified compliance से administrative burden कम होगा

Action Items:

- Threshold limit cross करने वाले businesses तुरंत register करें

- Required documents collect करके रखें

- Professional help consider करें complex cases में

- GST reforms के implementation का wait करें better rates के लिए

GST registration सिर्फ legal compliance नहीं है, बल्कि business growth का एक important tool है। नए reforms के साथ यह और भी beneficial होने वाला है सभी stakeholders के लिए।